Use popular tokens and stablecoins on the BPX Chain. Trade wrapped BPX on the Uniswap and other DEXes. Earn ETH, MATIC, AVAX and more by becoming a bridge validator. The BPX Decentralized Bridge is now live!

Original implementation that solves known issues

Most cross-chain bridges operating today rely on a set of relayers that perform on-chain voting on the validity of each transaction. This pattern is proven to be safe, but it has some drawbacks. The main problem is transaction fees. The voting mechanism requires making a transaction on the destination chain, by each relayer, for each transaction passing through the bridge. While this is quite tolerable in cheap gas networks, the costs of being a relayer on Ethereum mainnet can quickly grow to several thousand USD per day. Of course, these costs can be passed on to the bridge users, but it means the bridge can’t be fully decentralized, and the group of relayers can consists of only a few people trusted by the bridge owner. After all, fees of 5 voting transactions can be passed on to the single user, but fees of 5,000 such transaction cannot.

However, this is not the only problem. Relayers pay all fees in the native currency of the destination blockchain, but receive refunds from users on the source blockchain in its native currency, or even in a dedicated bridge token. The conclusion is that relayers are constantly exposed to exchange rate fluctuations between the currency of payment and the currency of refund, they must regularly exchange these assets and refill their wallets. Despite all the effort, it may ultimately turn out that the price of one currency has dropped significantly and the relayer’s entire activity generated a loss.

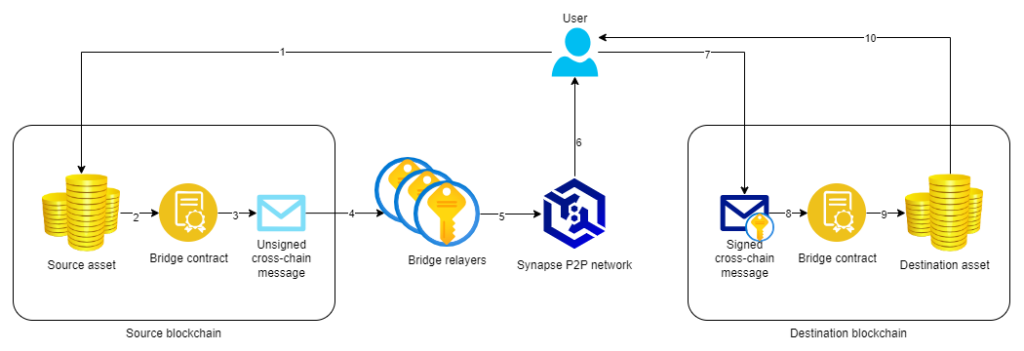

When creating the BPX Bridge, we set ourselves the goal of eliminating all these drawbacks. We have developed a decentralized bridge protocol, where relayers do not make any on-chain transactions. Instead transactions on both chains are initiated by the user. In our bridge architecure anyone can become a relayer and earn money by securing the bridge. There can even be millions of relayers, which does not increase transaction costs and makes the bridge more and more secure. Our proprietary algorithm delegates only 8 relayers out of all to sign a certain transaction. We are using the recently launched Synapse network as a communication layer between relayers and users.

To become a bridge relayer, a security deposit of approximately $1,000 (but on each chain in its native currency) must be locked in the bridge smart contract. The deposit will be fully refunded when the relayer is deactivated and no charges will ever be taken from it. The deposit protects against activation of a large number of relayers by a single person, which would threaten the security of the bridge. In addition, it protects the network against “abandoned” relayers who have not unregistered from the smart contract and have simply shut down the transaction signing software.

How to get started?

🌉 The BPX Bridge client interface is available at:

https://bridge.bpxchain.cc

The bridge have been initially launched on the BPX, Arbitrum, Polygon and Avalanche C-Chain networks and supports BPX, ETH, MATIC, AVAX, USDT and USDC tokens. More networks and assets coming soon.

The launch of BPX Bridge creates new possibilities for trading the BPX coin. Once you transfer your BPX coins to another chain, you can trade the wrapped BPX token on popular, high volume DEXes, like Uniswap or Pancakeswap. We believe that instead of using centralized exchanges, it should be the primary way of coming into possession of BPX coins. We encourage all BPX holders to provide some liquidity on BPX pairs on the mentioned exchange platforms.

To dive into the details of how our bridge works, check out the project documentation. You will also find instructions on how to become a relayer and earn money by validating bridge transactions.